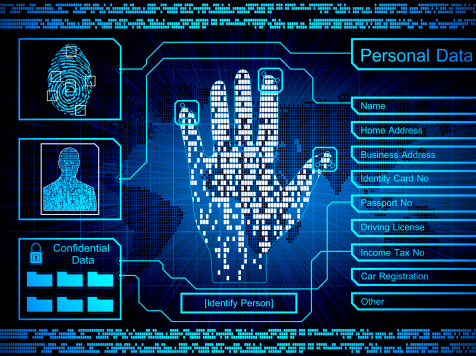

In the realm of financial security, a new sentinel has arisen, ushering us into an era where the human body becomes the key to our most valuable assets. Imagine a fortress guarded not by keys or codes, but by the unique signatures of our own bodies. This is the promise of biometrics. Today, we embark on a journey through the cutting-edge world of biometric technology and its profound impact on safeguarding our financial data.

The Biometric Symphony: Orchestrating Security through Unique Identifiers

Picture a world where your very essence, from the contours of your face to the rhythms of your heartbeat, is your passport to financial fortitude.

In the realm of biometrics, this vision has become reality.

Biometrics leverages unique physical and behavioral attributes to authenticate individuals. These identifiers, ranging from fingerprints and facial recognition to voice patterns and even heartbeat rhythms, create an impenetrable shield against unauthorized access.

Embrace biometric authentication methods offered by your financial institutions to add an extra layer of protection to your accounts.

According to a study by MarketsandMarkets, the global biometric system market is projected to reach $68.6 billion by 2024.

“Biometrics brings personal identity into the digital realm, enhancing both security and convenience.” – Michael Chertoff

A Symphony of Faces: Facial Recognition in Financial Transactions

Imagine a world where a glance holds the power to grant access to your financial kingdom, where your face is the only key you’ll ever need.

This is the reality of facial recognition technology.

Facial recognition technology maps and analyzes the unique features of a person’s face to verify their identity. This powerful tool is now being integrated into financial systems, providing a seamless and secure authentication method.

Enable facial recognition on your mobile devices for secure access to banking apps and sensitive financial information.

A report by Allied Market Research estimates that the facial recognition market will reach $11.6 billion by 2022.

“Facial recognition transforms a face into a digital key, unlocking a new era of convenience and security.” – Joy Chik

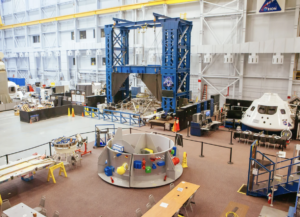

Beyond Fingerprints: Multimodal Biometrics for Unparalleled Security

Consider a world where your very touch holds the power to unlock your financial realm, but it doesn’t stop there.

Multimodal biometrics takes this concept to the next level.

Multimodal biometrics combines various biometric identifiers like fingerprints, facial recognition, voice patterns, and more. This approach creates a layered defense, significantly enhancing security by requiring multiple forms of authentication.

If available, opt for financial systems that offer multimodal biometric authentication for the highest level of security.

A report by TechSci Research predicts the global multimodal biometrics market to grow at a CAGR of over 18% from 2021 to 2026.

“In the realm of security, the power of multiple biometrics is unparalleled.” – Vijay Pullur

Voice Biometrics: The Sound of Secure Transactions

Envision a world where your voice is your signature, where the cadence of your speech unlocks the gates to your financial kingdom.

This is the promise of voice biometrics.

Voice biometrics analyzes unique vocal characteristics to verify identity. With advancements in this technology, it has become a powerful tool for secure financial transactions, offering both convenience and robust security.

Explore financial institutions that offer voice biometrics for phone-based transactions and account access.

According to a report by Zion Market Research, the global voice biometrics market is projected to reach $3.6 billion by 2025.

“Your voice is your signature, and in the realm of biometrics, it speaks volumes.” – Clive Summerfield

The Future of Security: Biometrics in a Hyperconnected World

In a world where connectivity is king, imagine a security system seamlessly integrated into every aspect of your financial life.

This is the potential of biometrics in a hyperconnected world.

As our lives become increasingly digital, the integration of biometrics into various platforms and devices ensures a consistent and secure user experience. From mobile banking to online shopping, biometrics paves the way for a safer financial future.

Stay informed about emerging biometric technologies and how they’re being integrated into the financial services you use.

A survey by Visa found that 68% of consumers are interested in using biometrics to authenticate payments.

“Biometrics creates a seamless bridge between the physical and digital realms, enhancing security in our interconnected world.” – Ajay Bhalla

As we stand at the threshold of a new era in financial security, biometrics emerges as the vanguard, wielding the power of our very beings to safeguard our most precious assets. Embrace this technological marvel, for it is not merely a tool, but a sentinel that will shape the future of financial protection. Together, let us transcend passwords and codes, and step into a future where our own biology stands as the key to our financial fortitude.