The process of refinancing your student loans may be made easier with the assistance of Aspire Student Loan Refinance, which offers customized solutions to meet your specific financial requirements. Find a more efficient technique to handle the management of student loans.

You need to have what credit score in order to apply.

In general, in order to be qualified for refinancing via Aspire Student Loan Refinance, candidates are normally need to have a credit score that is considered to be of a satisfactory level.

Although there may be variations in the particular credit score criterion, it is typically desirable to have a credit score that falls between the range of “good” to “excellent.”

Application procedure for the Aspire Student Loan Refinancing program

Throughout this evaluation, both the positive and negative aspects of the Aspira Student Loan Refinance service were discussed. After then, it is time to acquire the knowledge necessary to implement and delight in these advantages.

Proceed to read the second section of this blog article by clicking on the link provided below. Your new financial life is waiting for you, without a doubt!

A submission made online

The application procedure for Aspire Student Loan Refinance, which can help you have a better future, is broken down into the following steps:

Collect the Information about Your Loan: Before you start the application process, you should gather all of the information that is required regarding your current student loans, such as the amounts, interest rates, and information on the loan servicer;

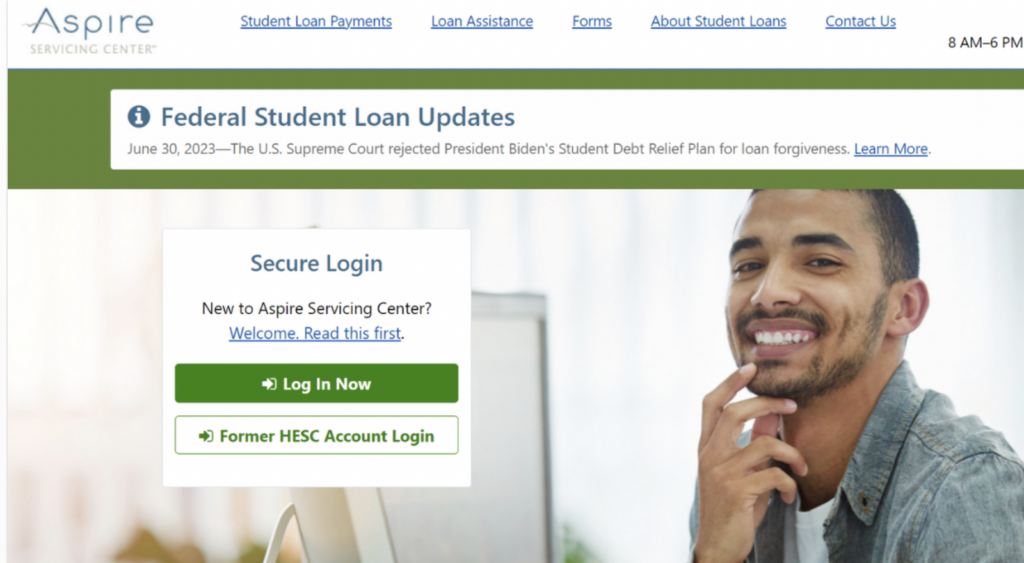

Establish a User Account: In addition, if you are qualified, you need register for an account on the website. Consequently, you will be needed to provide your email address, generate a password, and fill any other information that is specifically requested;

Please complete the application by: You should begin the application procedure as soon as your account has been created. In addition, it will ask you to enter personal and financial information, such as your income, work data, and the amount of the loan that you would want to get;

Examining the Loan Offers: You will then be presented with loan options that vary in terms of interest rates and payback periods, provided you are authorized for the loan.

You Can Pick Your Loan: Now, make sure you give each one of the loan offers a thorough examination. Choose the loan that is most suitable for your current financial circumstances and your long-term objectives.

Send in Your Documents: In order to verify the information you provided, they could ask for further papers. To put it another way, they may consist of pay stubs, tax returns, or other different types of financial documents. Additionally, submit the papers that are required in order to go on with the application;

The Consolidation of Loans: Therefore, they will begin the process of consolidating your debts, which will include paying off your current loans with the new loan that has been refinanced.

That is, what are the prerequisites?

It’s Time to Stop Juggling Loans: The repayment process is made easier with Aspire Student Loan Refinance. AdobeStock is the source.

In order to submit an application to this lender, you will need to satisfy the following requirements:

First and foremost, a high credit score, a consistent income, and job;

A low debt-to-income ratio is the second factor. An improved financial stability is shown by a ratio that is lower. Additionally, either an American citizen or a permanent resident.

In addition, the minimum age limit is sixteen years old.

Some lenders have certain educational criteria that must be met before they can lend money.

Forms of loans: Both federal and private student loans are eligible for refinancing via Aspire.

Cosigner who is optional: You may boost your application by obtaining a cosigner who has strong credit if it is required.

Make your application using the app.

Currently, the application procedure is entirely accessible online via their official website.

On the other hand, it is quite possible that their website has a user-friendly interface, which enables you to finish the application in a simple manner from either your desktop computer or your mobile device.