Simplify your life and go on the path to financial independence by applying for SoFi Student Loan Refinance. Learn all the steps in this detailed tutorial.

Do thoughts of paying off college debts plague you? Are you feeling overwhelmed by the prospect of juggling several payments with exorbitant interest rates? Read on to see how to fix it.

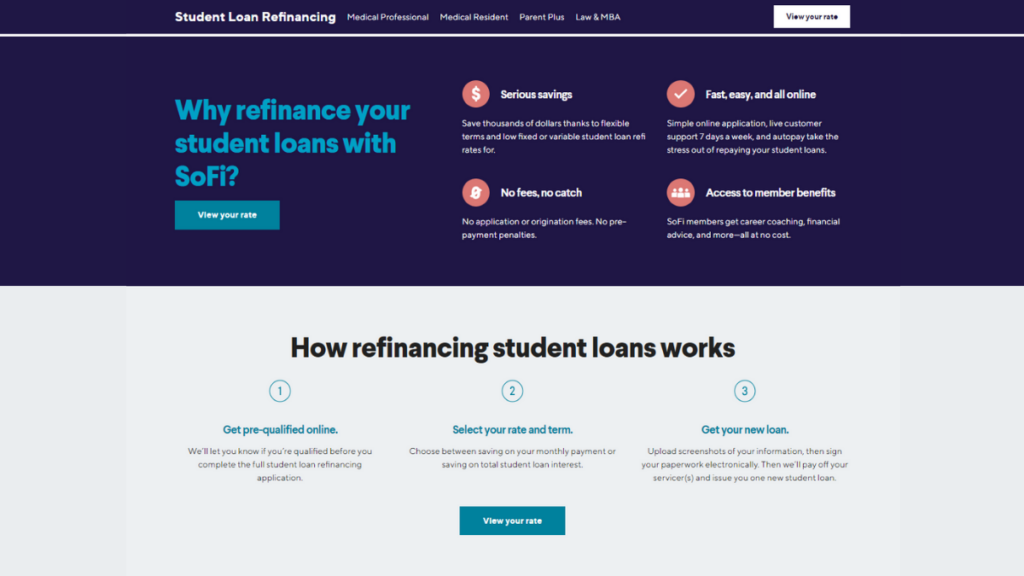

A number of benefits

The benefits and drawbacks of the Student Loan Refinancing offered by SoFi. As a source, SoFi

Straighten out Regarding Your Repayment: Make use of the ease that comes with combining numerous loans into a single one. Additionally, you will get a monthly payment that is easier to handle, which will ease the administration of your debt;

The Exclusive Benefits of Membership: You get access to a wide variety of exclusive privileges as a valued member of Sofi. Because of this, you will get individualized guidance about your career as well as complete financial planning;

No fees for the application or the initialization: The fact that Sofi does not impose any extra fees throughout the application procedure gives you the peace of mind you need. For the most part, you will be able to save money right from the beginning;

Rates of Interest That Are Appealing: On top of that, SoFi constantly offers competitive interest rates, which might possibly result in significant savings over the course of the full loan period;

Agreements that are Adaptable to Your Needs: Additionally, you have the ability to carefully build your repayment route by picking from a variety of loan terms that have been thoughtfully offered.

On the other hand,

If you refinance your federal student loans with Sofi, you run the risk of losing some government advantages, such as debt forgiveness and income-driven repayment plans. There is a possibility that you will lose these benefits.

Eligibility Requirements

That Are Strict In addition, not everyone will be able to qualify for Sofi’s refinancing since it normally demands a favorable credit score and a consistent income;

Your credit score may see a short drop as a consequence of a hard inquiry if you apply for refinancing; this is a potential impact on your credit score.

There is a possibility that, in contrast to government loans, Sofi loans may not provide the same amount of support with repayment in the event that the borrower is experiencing financial difficulties.

Request form sent electronically

You can streamline your repayment process and save money with SoFi Student Loan Refinance.

Therefore, welcome to monetary simplicity and farewell to complication.

- Sign up for a SoFi account.

First things first, create a free account with SoFi by visiting their website. After that, fill out the profile creation form with your basic details. - Gather Your Required Documents

Your identity, income documentation, and student loan statements should be at the ready. The application procedure will go more quickly if you have all the necessary items on hand.

Next, launch the app.

Next, go to your SoFi dashboard and find the “Refinance Student Loans” option. Click on it to start the application process.

Fill out the form accurately by following the on-screen instructions.

Step 4: Choose a Loan

You may personalize your refinancing plan by selecting the loan terms and interest rates that best suit your needs.

- Evaluate and Verify

Verify that all the details that have been supplied are accurate and comprehensive. Send in your application for evaluation when you’ve confirmed it. - Kindly Permit

Student Loan Refinancing on SoFi’s Site

Unwind and Refinance: Take a look at how SoFi may alleviate your loan burden by applying now. Here is the source: SoFi

While SoFi evaluates your application, you may unwind. As necessary, they could get in touch with you to get further details. - Say Yes to the Deal

You will be sent with a refinancing offer describing the terms and circumstances once it is approved.

In addition, make sure it fits with your objectives by reviewing it thoroughly before accepting.

- Finish the Procedure

Finally, to complete the loan refinancing procedure, follow the steps supplied by SoFi. There are certain papers that may need an electronic signature from you. - Rejoice at the Arrival of Financial Independence

Well done! Now that you’ve refinanced your student loans with SoFi, you can finally put your financial worries behind you and look forward to a future without debt.

In order to proceed, what must I do?

Refinancing your student loans with SoFi requires that you meet these criteria:

Credit rating of 680 or above is considered good to outstanding;

Reliable means of subsistence;

Have earned a degree from an approved institution; Be a citizen, permanent resident, or qualified non-resident of the United States;

Must be at least 18 years old.

Put your application in using the app

Sure enough, SoFi has a mobile app that you may use to manage your account, further simplifying things. You may also apply for a loan using the app, which is great news.

To access your SoFi account, all you have to do is download the app and enter your login credentials. Also, sign up for SoFi right now if you haven’t already; it won’t take more than a few seconds.

You will have access to a very user-friendly app when you have signed in.

If you want to take advantage of SoFi Student Loan Refinance, all you have to do is apply by following the on-screen instructions.