BMO CashBack World Elite MasterCard

-

Get your cash back ASAP!

Get your cash back ASAP!

No waiting! Redeem your cash back any time you want for as little as $1.

-

Roadside assistance

Including battery boosts, flat-tire change, lockout service and towing – a $69/year value.

-

Travel and medical protection

Travel and medical protection

With 8-day out-of-province/out-of-country emergency medical benefits – up to $5 million in coverage, and more.

-

2% on recurring bills

Like your phone bill, gym membership, and favourite streaming services.

Your cash back rewards never expire as long as your account is open and in good standing.

No waiting! Redeem your cash back any time you want for as little as $1.

Set up automatic deposits starting at $25.

Enjoy the flexibility to put your cash back where you want:

Statement credit

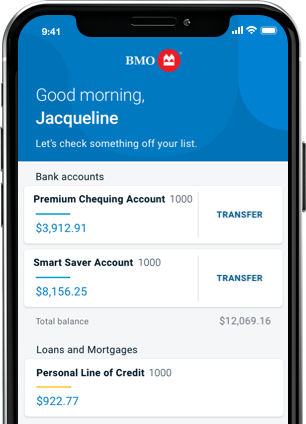

BMO chequing or savings account

InvestorLine

Enjoy free access to over 1 million Wi-Fi hotspots around the world with Boingo Wi-Fi for Mastercard Cardholders. Connect today by registering and activating your complimentary Boingo account.

Discover a world of Mastercard Travel Rewards cash back offers when you shop, dine and relax with our partners outside of Canada.

Access valuable benefits and offers for digital everyday services from a variety of on-demand apps and subscription services.

Earn even more cash back when you add another cardholder for $50 a year.

Save up to 25% off rentals at participating National Car Rental and Alamo Rent a Car locations.

Enjoy free 24-hour access to our experienced concierge staff.

Complimentary membership in Mastercard Travel Pass provided by DragonPass. As a member enjoy lounge access for a fee of just US$32 per person, per visit. Registration is required. Visit mastercardtravelpass.dragonpass.com or use the Mastercard Travel Pass mobile application to register.

Shop confidently with an extended warranty and purchase protection.

You might find yourself pondering the distinctive features that elevate a credit card to a special status. Well, there are several factors at play, and a credit card becomes noteworthy for various reasons. For instance, a credit card that provides substantial cash back, a plethora of benefits, including complimentary services, and does not impose an annual fee, stands out as undoubtedly exceptional. It’s the combination of these attributes that qualifies a card as truly outstanding in the realm of credit cards.

Now, you might think such a card doesn’t exist, but let me assure you it does, and it’s right in front of you. Today, I’ll be discussing the incredible BMO CashBack World Elite MasterCard. This card not only offers essential assistance when needed, but also provides extensive benefits, all without charging an annual fee. For further details, read on.

Interested in applying? Here are the requirements for the BMO CashBack World Elite MasterCard:

Typically, each credit card comes with its unique set of benefits, qualities, and conditions. To access and leverage these benefits, it’s crucial to meet specific requirements outlined by the card issuer. The BMO CashBack World Elite MasterCard is no exception. If you’re interested in discovering all the necessary requirements for applying for this card, please continue reading.

- Minimum personal income: $80,000

- Minimum household income: $150,000

- Minimum age: 18 Residency in Canada

Necessary documents for applying for the BMO CashBack World Elite MasterCard:

Now, let’s delve deeper into the credit card beyond its benefits and features. I’ll share something more intriguing – the specific types of individuals who are likely to derive exceptional value from the BMO CashBack World Elite MasterCard. Let’s explore below to discover the key profiles of individuals who will truly relish the benefits of this credit card.

- Proof of income

- Proof of residence

- Identification

Who should consider applying for the BMO CashBack World Elite MasterCard:

If you’re eager to explore more about this credit card, here’s a heads-up: while this card offers numerous benefits, you’ll need specific documents to apply for it. If you’re interested in learning about these required documents, keep reading, as I’ll detail them below.

BMO clients:

Primarily, individuals who are already clients of the bank are likely to find this credit card particularly appealing. Applying for a credit card from the same bank you’re a client of often increases the likelihood of approval. Moreover, once approved, there’s a higher chance of receiving a more substantial credit limit.

If you want a secure credit card

This is the type of credit card to have a perfect security. For example, when you shop online the credit card is going to add another layer of security so that you can shop safely, and it also protects you against frauds and scams meaning that you don’t need to worry too much about that because the credit card will help you if something like that happens.

If you enjoy cashback

Of course the main reason that this credit card was even created in the first place is because of cash back if you are someone that really enjoys cash back and really likes to buy things and get some money back then this is the perfect card for you because as I’ve said before this is the only card with 5% of cash back on groceries. Not only that, but it has a ton of cash back in order parts too.

If you want a flexible card

And of course you’re going to have a really flexible credit card if you apply for this one when you apply for a credit card that is flexible you will be able to expect a lot of things so you’ll be able to get a credit card a savings account and many other things that it will be able to be given to you by the BMO CashBack World Elite MasterCard.

Here’s a crucial piece of advice for those considering applying for the BMO CashBack World Elite MasterCard:

Have you considered the intricacies of the application process and the necessary steps to take? While I’m here to provide valuable guidance and advice during this pivotal moment, it’s important to acknowledge that a significant portion of the responsibility lies on your end.

When applying for a credit card, especially one as notable as the BMO CashBack World Elite MasterCard, it’s essential to familiarize yourself with the requirements and understand the terms and conditions associated with the card. Assess your financial situation, review your credit history, and ensure you meet the eligibility criteria.

One essential tip, given the remarkable benefits of this credit card, is to thoroughly read and understand the terms and conditions before applying. While it offers a fantastic 5% cashback on groceries, it’s vital to comprehend the specifics. What qualifies as ‘groceries’ under this benefit? Knowing this helps ensure you can make the most of the rewards for the purchases you want to make.

Is this card truly worth considering? Let’s weigh the pros and cons.

In my view, this credit card truly distinguishes itself as an outstanding option. Amidst the varied landscape of credit cards, each with its own set of pros and cons, this particular card notably tilts towards the positive side. Personally, I find the generous cashback feature to be the standout aspect, although it’s merely one among a plethora of benefits. Taken as a whole, it presents a well-rounded package with few drawbacks, rendering it a highly compelling choice.

Ready to apply for the BMO CashBack World Elite MasterCard?

If you’re enthusiastic about obtaining this credit card, I warmly invite you to explore the wealth of information that lies ahead. By continuing your reading journey, you will unravel a comprehensive guide encompassing all the indispensable details essential for advancing through and successfully concluding your application process.

This in-depth exploration will empower you with the knowledge needed to navigate each aspect seamlessly, ensuring a smooth and informed progression towards the completion of your credit card application. Your commitment to perusing this information will not only deepen your understanding but also enhance your ability to make well-informed decisions throughout the application journey, ultimately leading to a successful and satisfying outcome.