KOHO Premium Visa

-

Annual Fee

0

-

Rewards rate2% cash back on groceries, eating & drinking, and transportation

-

Intro offerUp to 5% extra cash back at selected merchants

-

Recommended Credit Score

Good to excellent score.

Why get a virtual KOHO card?

Guaranteed approval: open a KOHO account and get your virtual card right away with no credit checks, and no need to wait for a physical card

Spend & save instantly: shop with your card in-store and online and earn up to 6% cash back on your spending

No wallet, no problem: easily add your card to your virtual wallet for easy tapping at the checkout

Manage your subscriptions: transfer your subscription and any recurring payments to your KOHO account straight away using your virtual card number

Stay safe & secure: Instantly lock and unlock your virtual card through the app and have peace of mind with top security protection

What is a virtual card handy for?

Travelling

Having your virtual card on your phone is the most secure way to keep your money safe while abroad.

Online Shopping

No need to scramble for your wallet when shopping online — access your card details easily in the app.

Keeping it Simple

Reduce your plastic waste and streamline how you manage your money.

In-a-pickle moments

Forgot your wallet? No worries. Adding your card to Apple, Samsung, or Google Pay will keep you covered.

Are you interested in a credit card that stands out from the rest? I’m sure you’ve heard about the various types of credit cards, whether they’re tied to specific stores, issued by companies for travel or purchases, or aimed at improving your credit score. But what if you’re looking for a different kind of credit card?

What if you desire a credit card that offers more cash back or allows you to customize your interest rate? What if you’re seeking a credit card that, for a small fee, can help boost your credit score? Fortunately, such a credit card does exist, and it goes by the name KOHO Premium Visa. If you’re eager to learn more about this unique credit card, then continue reading.

Requirements to Apply for the KOHO Premium Visa:

Every credit card, including the KOHO Premium Visa, comes with its own set of requirements. Regardless of personal preferences or desired features, these requirements are akin to laws in the world of credit cards. Whether you acknowledge them or not, every credit card has them. Let’s take a closer look at the requirements for the KOHO Premium Visa.

- Must be at least 18 years old.

- Must be a Canadian resident.

- Must have all necessary documents.

Necessary Documents for Applying for the KOHO Premium Visa:

True to my word, I am here to provide you with more information about this special credit card. Now, let’s discuss all the documents you might need while applying for it. Keep in mind that these documents should be official, as copies may not be accepted. Before you begin the application, it’s essential to ensure you have the following:

- Proof of identity.

- Proof of residence.

These documents are crucial for a successful application process, if you’re curious to know more about this credit card or wish to apply, read on.

Who should apply for the KOHO Premium Visa credit card?

There may be several questions regarding who should consider applying for this credit card, and to be honest, all of these inquiries are valid. You might initially think that when starting the application for a credit card, it’s sufficient to be aware of the benefits. However, understanding the ideal profile to maximize the card’s advantages is equally important. Let’s delve into the specifics.

KOHO Clients:

Certainly, one of the key profiles for this credit card includes individuals who are already clients of the company. While some companies offer extra benefits to their clients, the KOHO Premium Visa takes a different approach. Instead of additional benefits, you may have the opportunity to achieve a higher credit score or enhance the existing benefits you already enjoy.

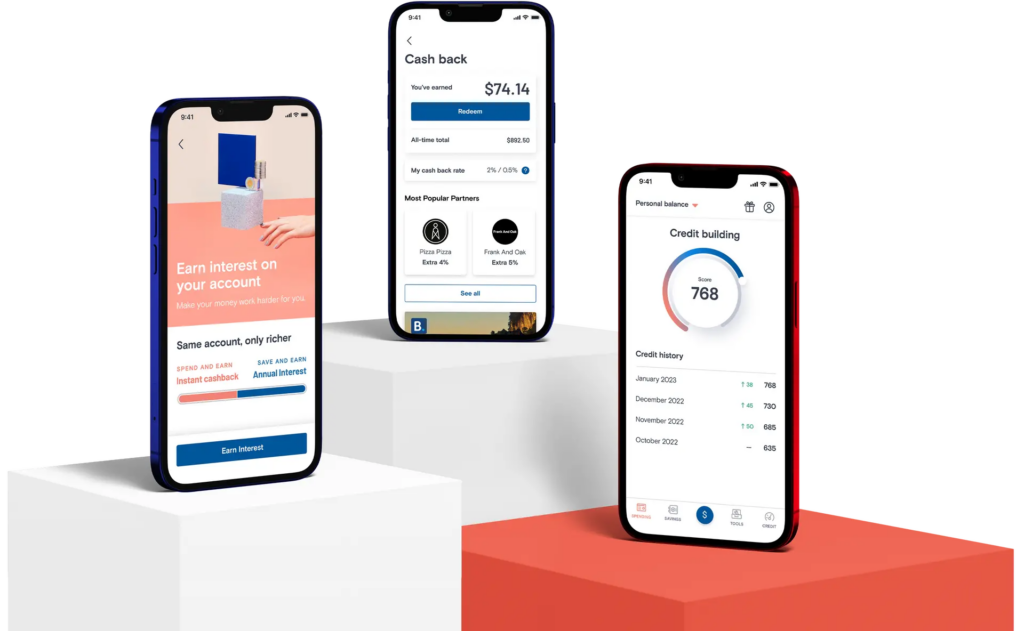

Cashback Enthusiasts:

For those who appreciate earning cash back, the KOHO Premium Visa offers a substantial amount. You can enjoy significant cash back when making purchases, allowing you to receive a portion of your spending back. If you take pleasure in gaining extra money through your credit card, even if it’s not a substantial amount, this credit card might be a suitable choice.

If you enjoy making purchases:

This category is a bit more general. Yes, you can apply for the KOHO Premium Visa if you enjoy making purchases. Although it may not offer an abundance of purchasing benefits, the fact that it provides cash back, is internationally recognized, and is generally suitable for buying things makes it an enjoyable option. You can find satisfaction in using this credit card for your purchases.

If you need to build credit history:

Certainly, another eligible profile is if you need to build your credit history. While this may not be the main feature of the credit card, it’s a beneficial aspect that you might find particularly appealing. When applying for a credit card, accruing positive benefits is possible, and in the case of the KOHO Premium Visa, you can work towards building your credit history for a nominal fee of seven.

One piece of advice for those wishing to apply for the KOHO Premium Visa:

You might be wondering what invaluable guidance I can offer, advice that extends beyond just this credit card, perhaps applicable to future credit cards as well. Well, I have a singular piece of advice for you that, if followed, can enhance your chances of obtaining any financial services or credit cards you desire.

I am confident that if you adhere to this counsel, you’ll be well-positioned to achieve your financial goals. The advice I’m imparting is straightforward: prioritize the improvement of your credit score and credit history. While the KOHO Premium Visa may provide some assistance in this regard, it’s essential to recognize that it isn’t specifically tailored for this purpose.

This implies that you should seek a credit card explicitly designed to help build and improve your credit. If you currently have a less-than-ideal credit score, this might not be the ideal card for you. Instead, invest some effort in elevating your credit score before acquiring this credit card. Once you have it, continue working on maintaining and enhancing your credit score to attain the highest possible financial standing.

Is the KOHO Premium Visa Worth It? Let’s Compare the Pros and Cons:

As you consider whether the KOHO Premium Visa is the right choice for you, it’s essential to weigh its pros and cons. While this credit card has some drawbacks, such as the absence of additional services and the presence of an annual fee, which, although not ideal, isn’t overly burdensome, let’s compare these downsides with the benefits.

On the positive side, the fact that the KOHO Premium Visa is an international card, coupled with the potential for significant cash back, makes it a compelling option. When contrasting the advantages with the drawbacks, I believe that the overall value proposition justifies considering this card over other options.

Apply now for the KOHO Premium Visa:

If you’re intrigued by the features and benefits of the KOHO Premium Visa, take the next step and click on the button below to learn more about the card. Start your application now and explore everything this credit card has to offer. Don’t miss the opportunity to delve into the details and make an informed decision about whether the KOHO Premium Visa aligns with your financial needs and preferences.