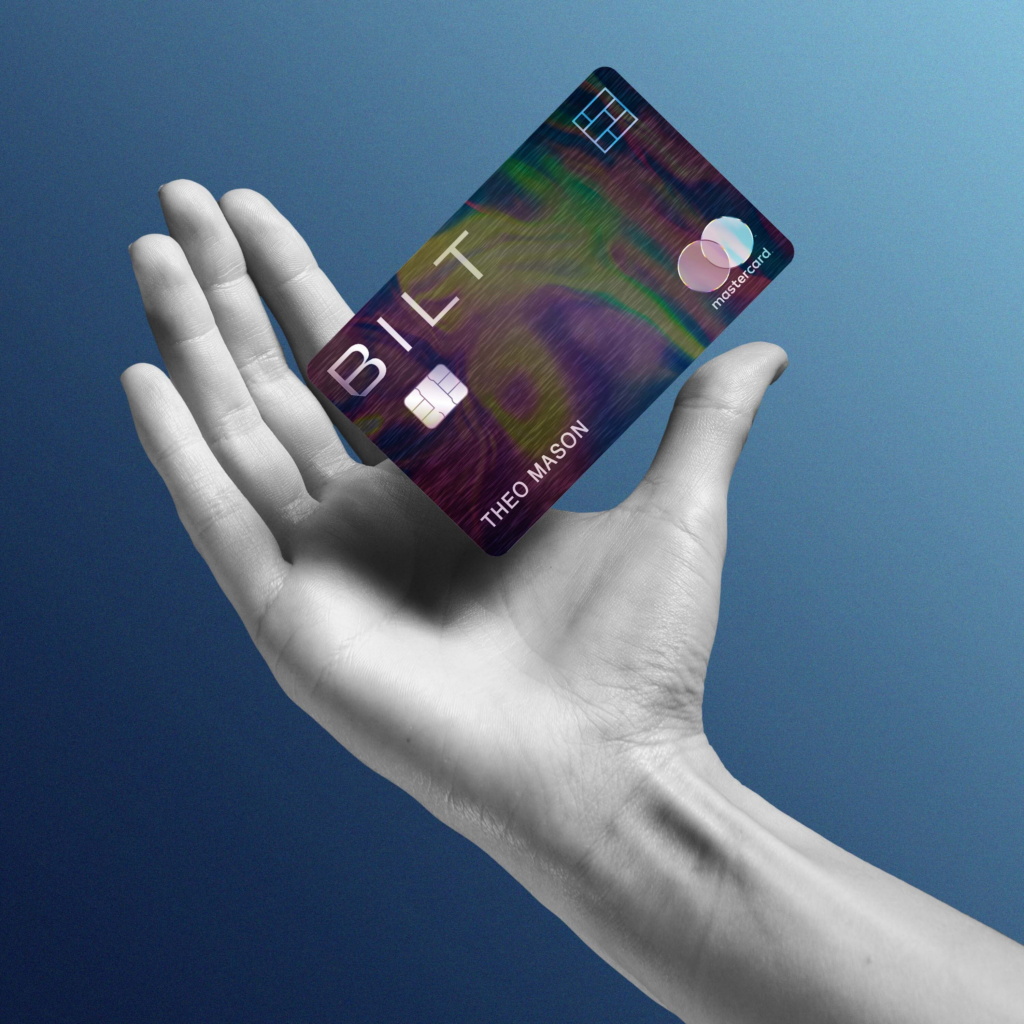

Wells Fargo Bilt Mastercard®

-

Annual Fee

No annual fee

-

Rewards rate

Earn 6X points on dining, 4X points on travel, and 2X points on other purchases (except rent).*

-

Intro offer

Bilt Points ranked as the most valuable rewards points (above Amex Membership Rewards and Chase Ultimate Rewards).

-

Recommended Credit Score

Good to excellent score.

- Rewards Program: Earn points or cash back on purchases, potentially with higher rates in specific categories like travel, dining, or groceries.

- Travel Benefits: May include travel insurance, no foreign transaction fees, and other travel-related perks.

- Introductory Offers: Possible low or 0% introductory APR on purchases and/or balance transfers for a limited time.

Offers up to $5,000 reimbursement for a non-refundable passenger fare if your trip is interrupted or canceled for a covered reason, when your passenger fare is booked with your Bilt Mastercard®.

Get reimbursed for expenses incurred, including meals, when your trip is delayed more than six hours due to covered reasons like inclement weather, mechanical breakdown of the common carrier or air traffic control delays.

Receive auto coverage for covered damages due to collision or theft for most rental cars when you pay for the rental transaction with the Bilt Mastercard.

No foreign currency conversion fee

When you use your card for travel, you won’t pay a foreign currency conversion fee for purchases converted to U.S. dollars.

Take 3 rides in one calendar month, get a $5 Lyft credit with your Bilt Mastercard®.

Are you in search of a credit card that not only fits seamlessly into your financial portfolio but also amplifies your everyday spending? The Wells Fargo Bilt Mastercard® might just be the card you’re looking for.

This card is known for its unique approach to rewards and financial flexibility, making it a standout choice in the competitive world of credit cards. Let’s delve into the requirements and necessary documentation to acquire this versatile financial tool.

What Are the Requirements to Apply?

To apply for the Wells Fargo Bilt Mastercard®, there are certain key criteria you need to meet. Firstly, age is a fundamental requirement. You must be at least the age of majority in your province or territory, typically 18 or 19 years old, to be eligible.

Residency is another important factor. Applicants should ideally be residents of the area where the card is offered to take full advantage of its benefits. This ensures that the card’s features and rewards align with your geographical and financial environment.

Employment and income are crucial as well. Wells Fargo likely looks for applicants who have a stable job and a reliable source of income. This helps in determining your financial capability to manage credit effectively. While the specific income requirements may vary, having a solid financial background is advantageous.

What Documents Are Required?

When you’re ready to apply for the Wells Fargo Bilt Mastercard®, having the right documents at hand is essential for a smooth application process. These typically include:

- Proof of Identity: A valid government-issued ID such as a driver’s license or passport to verify your identity.

- Proof of Residency: Documents like a utility bill or a lease agreement that show your current address.

- Proof of Income: Recent pay stubs, tax returns, or other documents that can affirm your income level. This is important to show that you meet any income requirements set by Wells Fargo.

- Credit Information: Wells Fargo will assess your credit score and history. Having information about your current debts and credit accounts can be helpful.

Gathering these documents beforehand will ease your application process, making you one step closer to enjoying the benefits of the Wells Fargo Bilt Mastercard®.

For the Avid Traveler

The Wells Fargo Bilt Mastercard® could be a great companion for those who travel frequently. If the card offers rewards on travel-related expenses, it would be particularly beneficial for globetrotters. The potential for earning points on flights, hotel stays, and other travel expenses can add significant value for frequent travelers, making every trip more rewarding.

For the Everyday Spender

If this card offers cash back or points on everyday purchases, it would be ideal for regular spenders. Those who use their card for daily transactions like groceries, gas, or dining out could accumulate rewards quickly. It’s perfect for individuals who prefer using credit cards over cash for their everyday spending, maximizing the benefits from their regular expenses.

For the Points Maximizers

The Wells Fargo Bilt Mastercard® might appeal to those who love accumulating and redeeming points. If the card allows for points to be used towards a variety of rewards such as travel, gift cards, or merchandise, it would be ideal for those who enjoy the flexibility and freedom to choose how they use their rewards.

For the Financially Savvy

If the Wells Fargo Bilt Mastercard® offers competitive interest rates or other financial management tools, it could be well-suited for the financially savvy individuals. Those who are looking for a card that supports their financial strategy, whether it’s building credit, transferring balances, or managing larger purchases, would find value in such features.

Our Advice for Prospective Wells Fargo Bilt Mastercard® Applicants

For those considering the Wells Fargo Bilt Mastercard®, our advice is to thoroughly assess how its features align with your spending habits and financial goals. Consider the rewards structure and if it matches your typical spending categories. If you travel often or make most of your purchases on a credit card, the rewards program could be highly beneficial.

Be mindful of the terms and conditions, especially concerning interest rates and fees. Evaluating these factors against your financial habits, such as paying off balances each month, is crucial to ensure this card is a cost-effective choice for you.

Lastly, consider the card’s benefits in the context of your overall financial strategy. If the Wells Fargo Bilt Mastercard® complements your financial objectives and lifestyle, it could be a valuable addition to your wallet.

Weighing the Pros and Cons – Is It Worth It?

After carefully considering the features of the Wells Fargo Bilt Mastercard®, it’s clear that this card offers several compelling advantages that could make it a valuable addition to your financial toolkit. For those who frequently travel or make a significant portion of their purchases in categories that earn rewards, this card can be particularly beneficial.

The potential to earn points or cash back on everyday spending, coupled with any travel-related rewards, positions it as a strong contender for both regular spenders and travel enthusiasts.

Additionally, if the card offers perks like low introductory rates or tools for financial management, it could be a strategic choice for individuals looking to streamline their finances or manage larger purchases effectively.

On the flip side, it’s important to consider any potential drawbacks such as annual fees or interest rates post any introductory period. The key is to weigh these costs against the benefits you expect to receive based on your spending habits and lifestyle.

In summary, for those who align with the card’s rewards structure and can leverage its benefits to the fullest, the Wells Fargo Bilt Mastercard® seems to be a worthwhile choice. It offers a blend of rewards and convenience that can enhance your financial experience, provided it matches your personal and financial circumstances.

Apply Now for the Wells Fargo Bilt Mastercard® on the Official Website!

Ready to take the next step and start reaping the benefits of the Wells Fargo Bilt Mastercard®? Applying is just a click away. By clicking the button below, you will be directed to the official Wells Fargo website where you can apply for the card.

The application process is simple, allowing you to quickly and efficiently secure a card that could transform your spending into earning.

Whether you’re looking to maximize rewards on your everyday expenses or want a card that aligns with your travel lifestyle, the Wells Fargo Bilt Mastercard® is here to meet your needs. Click below to begin your application and embark on a journey of rewarding experiences!