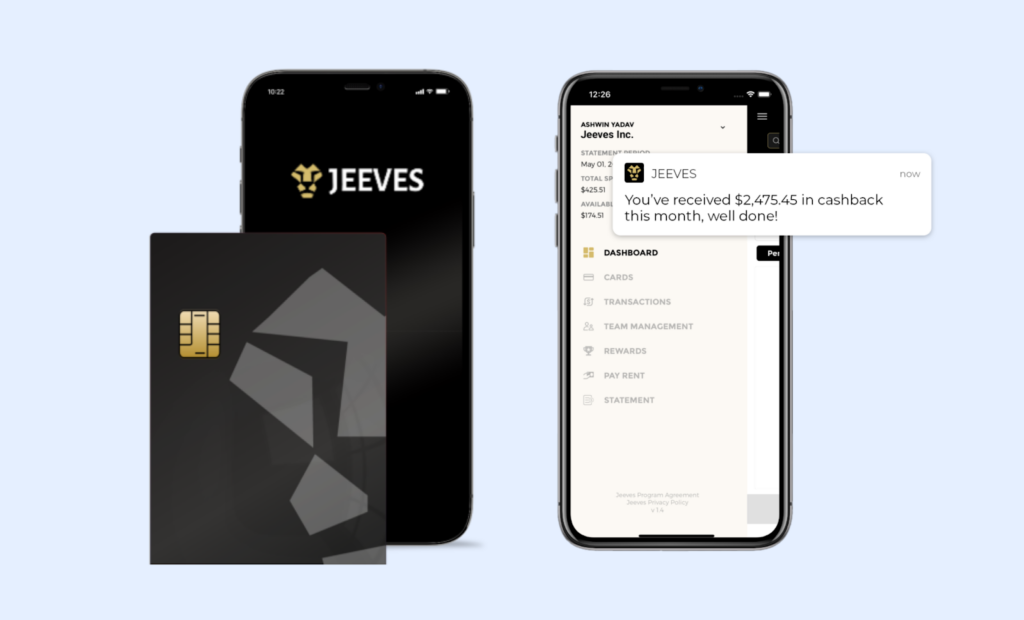

Jeeves Corporate Card

What’s the best action you could take when applying for a credit card? Many might wonder why this question holds significance. Let’s consider the following scenario: You decide to apply for a seemingly good credit card, thinking it aligns with your needs. However, without conducting thorough research, you base your decision solely on the company’s reputation and the widespread use of their cards.

Ordinarily, this might not pose a significant issue. It could turn out alright, seemingly a decent credit card. But then, you gradually realize a discrepancy. The card offers numerous benefits, yet you don’t find yourself utilizing them in your daily life. Had you delved deeper before applying, you might have second-guessed your choice.

To address the initial question, the optimal course of action would have been conducting extensive research about the credit card. And that’s precisely what you’re doing today—seeking one of the finest credit cards available, namely, the Jeeves Corporate Card. If you’re keen on discovering every aspect of this credit card, continue reading for a comprehensive understanding.

Why do we recommend the credit card Jeeves Corporate Card?

You might be wondering why this particular credit card is our recommendation, why we propose it as the one you’d want to apply for—maybe even spend years with, or perhaps, the rest of your life? Well, it doesn’t necessarily have to be a permanent fixture. Typically, people apply for credit cards quite frequently.

So, if you’re considering applying for this card, don’t view it as a permanent solution. The primary reason I advocate for this credit card is due to its myriad of benefits. You see, this card is incredibly versatile, and when I recommend a credit card to someone, I often opt for the ones that offer greater flexibility.

More flexible cards tend to attract a broader audience, leading to a larger client base. Consequently, the company is incentivized to work harder, enhancing the credit card and its associated benefits. It’s all part of a cycle; initiating it can enable you to maximize its advantages. That’s primarily why I recommend it.

Our opinion about the credit card Jeeves Corporate Card:

My perspective on this credit card closely aligns with why I recommend it. Initially, when I encountered this card, it struck me as quite unusual because it’s not the type of credit card I usually come across. It’s from a company that offers only one card—a company that, to be more specific, is a financial institution.

However, upon closer inspection, despite its unconventional nature and departure from the typical card offerings, it boasts remarkable benefits that, as I mentioned earlier, exhibit remarkable flexibility. It encompasses travel and purchase benefits and gives off an impression of exceptionally high quality. Considering all these factors, I believe this card might be worthwhile if you’re considering applying for it.

Learn the pros that Jeeves Corporate Card has:

Every credit card has specific attributes that make them advantageous and beneficial for users—these are the pros and cons of your card. This particular card stands out with some fascinating pros that I’m excited for you to explore. If you’re keen on discovering all the benefits this credit card offers, read on, and I’ll guide you through it.

- Unlimited card shipped globally

- Worldwide acceptance

- Seamless spend controls

- World-class rewards

Cons that the credit card Jeeves Corporate Card has:

Yes, unfortunately, you read that right. This card also has its drawbacks, as any other credit card does. Everything, including the Jeeves Corporate Card, has its downside. If you’re interested in learning about the aspects that might not align with your preferences, continue reading below.

- Not much information available

- Doesn’t offer many additional services.

How is the credit analysis made with the Jeeves Corporate Card:

Indeed, this credit card undergoes a credit analysis. If you’re seeking a credit card that doesn’t involve a credit analysis, this might not be the ideal choice for you. You’d need to look for a very specific type of card before applying. Let’s delve into the credit analysis process for the Jeeves Corporate Card.

For this card, the credit analysis unfolds like this: When you apply for the card, you’ll fill out a form with various personal details. The company will then use this information to scrutinize your credit history. It’s a relatively straightforward process that can be quite swift, so there’s no need to worry about spending a lot of time on it.

Why choose this card?

Does this card have a pre-approved limit?

Upon thorough examination of the official credit card page, I have conspicuously failed to unearth any pertinent information regarding pre-approved limits—a characteristic often found on credit cards that are devoid of this explicit specification. Consequently, in the absence of a pre-approved limit disclosure, it is advisable to embark on a prudent evaluation of your credit score.

For it is this numerical representation of your creditworthiness that will inevitably serve as the foundational determinant for your credit limit. This approach operates as an expeditious mechanism for the credit card company to judiciously allocate a credit limit commensurate with your financial standing.

By scrutinizing your credit score, the company can swiftly and accurately ascertain the credit limit that aligns with your creditworthiness, providing you with a limit that is reflective of your financial responsibility and ability to manage credit. Therefore, in the absence of explicit details on pre-approved limits, a careful evaluation of your credit score emerges as an indispensable step in understanding and navigating the potential credit boundaries associated with the utilization of the credit card in question.

Do you want to apply for it? Learn now how you can do it!

To initiate the application process for this credit card, you won’t encounter a cumbersome set of requirements; rather, a straightforward approach awaits you. Simply delve into the succeeding segment of this article, where you will gain comprehensive insights into each step indispensable for completing the application process seamlessly.

This concise guide will furnish you with the essential information and instructions, demystifying the application procedure and ensuring that you are well-equipped to navigate through the requisite steps effortlessly. So, without further ado, let’s proceed to unravel the straightforward and user-friendly steps that will pave the way for your successful application for the coveted credit card.