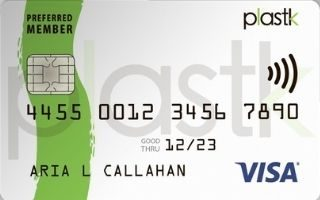

Plastk Secured Visa Credit Card

Are you curious about the world of credit cards and looking to start your journey with a reliable option? The Plastk Secured Visa Credit Card could be the perfect fit for you! Let’s dive into what this card offers and how you can easily get your hands on it.

Why We Recommend the Plastk Secured Visa Credit Card

When it comes to managing finances and building credit, the Plastk Secured Visa Credit Card stands out as a remarkable option, especially for Canadians. The first and foremost reason for our recommendation is its accessibility. Unlike traditional credit cards, the Plastk Secured Visa is attainable even for those with less-than-perfect credit scores. This makes it an excellent tool for rebuilding or establishing credit.

Another significant advantage of the Plastk Secured Visa is its rewards system. Earning points on everyday purchases that can be redeemed for a range of rewards is a feature usually reserved for unsecured cards. With Plastk, however, even those new to credit or working on improving their scores can enjoy these perks.

Additionally, the Plastk Secured Visa is user-friendly, with an intuitive app that makes managing your account a breeze. The app’s features, such as real-time balance updates and transaction alerts, enhance the overall experience and help users stay on top of their finances.

Furthermore, the security features of the Plastk Secured Visa are top-notch. With the rise in financial fraud and identity theft, having a card that prioritizes security is crucial. The Plastk Secured Visa offers peace of mind with its robust security measures.

In conclusion, the Plastk Secured Visa Credit Card is not just a financial tool but a stepping stone towards better financial health. Its blend of accessibility, rewards, user-friendliness, and security make it a top recommendation for Canadians looking to improve their credit.

Our Perspective on the Plastk Secured Visa Credit Card

Our perspective on the Plastk Secured Visa Credit Card is overwhelmingly positive, mainly due to its unique position in the Canadian credit card market. This card is more than just a means to spend; it’s a financial learning tool, especially for those new to credit or looking to rebuild.

One of the standout features of the Plastk Secured Visa is its educational component. The card comes with resources that guide users on responsible credit usage and financial management. This educational approach is invaluable for anyone aiming to improve their financial literacy and creditworthiness.

The cashback rewards program of the Plastk Secured Visa is another aspect worth mentioning. It’s rare for a secured card to offer such benefits, and this feature significantly enhances its appeal. Users earn points on their purchases, which can be redeemed for cashback, merchandise, or even travel, adding a layer of value to every transaction.

Moreover, the card’s flexibility in credit limits, based on the security deposit, caters to a wide range of financial situations. This adaptability means that users can start small and gradually increase their limit as their financial stability grows.

Advantages of the Plastk Secured Visa Credit Card

The Plastk Secured Visa Credit Card offers several appealing advantages for Canadians. Primarily, it’s a great tool for building or rebuilding credit. Since it’s a secured credit card, it’s accessible even to those with no credit history or a less-than-stellar credit score. This inclusivity makes it an excellent starting point for financial growth.

Another significant advantage is the rewards program. Users can earn points on everyday purchases, which is a rarity among secured credit cards. These points can be redeemed for various rewards, adding a layer of value to each transaction.

The card’s user-friendly nature is also worth noting. With an intuitive app, users can easily track spending, view balances, and receive real-time transaction alerts. This feature promotes better financial management and awareness.

Moreover, the security features of the Plastk Secured Visa are robust, offering protection against fraud and unauthorized transactions. This aspect is particularly important in today’s digital age, where financial security is paramount.

In essence, the Plastk Secured Visa offers a unique combination of accessibility, rewards, user-friendliness, and security, making it a solid choice for those looking to establish or improve their credit in Canada.

Disadvantages of the Plastk Secured Visa Credit Card

However, the Plastk Secured Visa Credit Card does have some drawbacks. The most notable is the requirement of a security deposit, which can be a barrier for individuals with limited funds. Additionally, the interest rates and fees may be higher compared to some unsecured credit cards, which could be a concern for those who carry a balance. It’s important for potential users to weigh these factors against the benefits when considering this card.

Credit Analysis for the Plastk Secured Visa

Credit analysis for the Plastk Secured Visa is uniquely accommodating. Unlike many traditional credit cards, the application process for the Plastk Secured Visa does not solely rely on credit scores. This approach is particularly beneficial for individuals with no credit history or those looking to rebuild their credit.

The process involves a review of the applicant’s financial situation, including income and existing debts. This holistic approach ensures that the card is accessible to a broader range of applicants, including those who might not qualify for unsecured credit cards.

Furthermore, the required security deposit for the Plastk Secured Visa acts as collateral and determines the credit limit. This feature minimizes risk for the issuer while providing the cardholder with a credit limit that aligns with their financial capacity.

Why choose this card?

Is There a Pre-Approved Limit?

The Plastk Secured Visa Credit Card comes with a unique feature: its credit limit is directly influenced by your security deposit. Typically, the limit ranges between $300 to $10,000. This flexible range means that you have control over your credit limit based on the amount you can deposit. It’s an excellent way to manage your spending and build your credit score, especially if you’re new to credit cards or working on rebuilding your credit.

Want to Apply? Learn How to Get the Plastk Secured Visa Credit Card Right Here!

Ready to take control of your financial future with the Plastk Secured Visa Credit Card? It’s simple! Just click the button below to learn more about the application process. We’ll guide you through each step, ensuring a smooth and hassle-free experience. Don’t miss out on this opportunity to build or rebuild your credit while enjoying the perks of a secured credit card. Click below and start your journey toward financial empowerment!