Introduction to the Mortgage Approval Process

Purchasing a home is an exciting milestone in one’s life, but navigating the mortgage approval process can be overwhelming for first-time buyers. Whether you’re a seasoned homeowner or a first-time buyer, understanding the steps involved in obtaining a mortgage is crucial. This comprehensive guide will provide you with the knowledge and tools necessary to navigate the mortgage approval process with confidence.

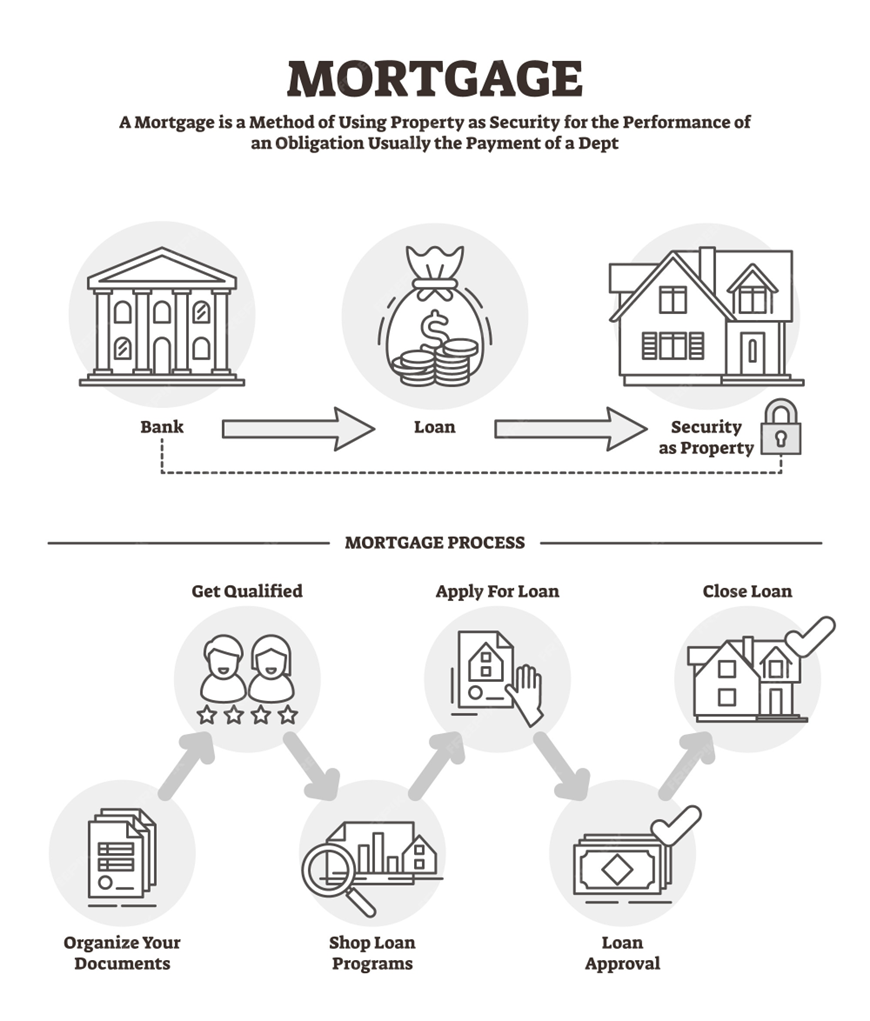

The mortgage approval process is a series of steps that lenders follow to assess your eligibility for a home loan. It begins with gathering and reviewing your financial information and ends with the lender’s decision to approve or deny your mortgage application. Understanding this process is essential to ensure a smooth and successful homebuying journey.

Understanding Different Home Loan Types

Before diving into the mortgage approval process, it’s important to familiarize yourself with the different types of home loans available. Each type of loan has its own set of requirements and benefits, so choosing the right one for your financial situation is crucial.

- Conventional Loans: These are traditional mortgages offered by banks and private lenders. They typically require a higher credit score and a larger down payment but offer favorable interest rates for borrowers with good credit.

- FHA Loans: Backed by the Federal Housing Administration, FHA loans are popular among first-time homebuyers. They require a lower credit score and a smaller down payment, making them more accessible to borrowers with limited funds.

- VA Loans: VA loans are exclusively available to active-duty military personnel, veterans, and their eligible spouses. These loans offer competitive interest rates, require no down payment, and have more lenient credit requirements.

- USDA Loans: USDA loans are designed for low to moderate-income borrowers in rural areas. They offer 100% financing and low-interest rates, making homeownership more affordable for those who meet the eligibility criteria.

Understanding the different home loan types will help you narrow down your options and choose the one that aligns with your financial goals and circumstances.

How to Improve Your Credit Score for a Better Chance at Approval

Your credit score plays a significant role in the mortgage approval process. Lenders use it to assess your creditworthiness and determine the interest rate you qualify for. If your credit score is less than ideal, taking steps to improve it can increase your chances of getting approved for a mortgage and securing a favorable interest rate.

- Check Your Credit Report: Start by obtaining a free copy of your credit report from each of the three major credit bureaus. Review it carefully for errors or discrepancies and dispute any inaccuracies you find.

- Pay Your Bills on Time: Consistently paying your bills on time is one of the most effective ways to improve your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

- Reduce Your Debt: High levels of debt can negatively impact your credit score. Paying down your existing debts, such as credit card balances or personal loans, can improve your credit utilization ratio and boost your credit score.

- Avoid Applying for New Credit: Opening new credit accounts can temporarily lower your credit score. Avoid applying for new credit cards or loans during the mortgage approval process.

By taking proactive steps to improve your credit score, you can present yourself as a more attractive borrower to lenders and increase your chances of mortgage approval.

Common Mistakes to Avoid During the Mortgage Approval Process

While navigating the mortgage approval process, it’s important to be aware of common mistakes that can hinder your chances of securing a home loan. Avoiding these pitfalls will help ensure a smoother path to homeownership.

- Changing Jobs or Income: Lenders prefer stability when assessing your ability to repay a mortgage. Switching jobs or experiencing a significant change in income during the mortgage approval process can raise red flags and potentially jeopardize your loan application.

- Making Large Purchases: Avoid making significant purchases, such as buying a new car or furniture, during the mortgage approval process. These purchases can increase your debt-to-income ratio and affect your eligibility for a home loan.

- Neglecting to Shop Around: Comparing mortgage offers from different lenders is crucial to secure the best terms and interest rates. Failing to shop around and settle for the first offer you receive could result in missed opportunities for better loan terms.

- Skipping the Pre-Approval Process: Getting pre-approved for a mortgage before house hunting is essential. It provides you with a clear understanding of your budget and strengthens your offer when making an offer on a home.

By avoiding these common mistakes, you can streamline the mortgage approval process and increase your chances of successfully securing your dream home.

Conclusion: Securing Your Dream Home Through a Successful Mortgage Approval

Securing your dream home begins with understanding and navigating the mortgage approval process. By familiarizing yourself with the steps involved, exploring different home loan types, improving your credit score, and avoiding common mistakes, you can increase your chances of obtaining a mortgage that aligns with your financial goals.

Remember, patience and diligence are key throughout the mortgage approval process. Take the time to gather all necessary documents, work on improving your credit score, and consult with professionals when needed. With the right knowledge and preparation, you’ll be well on your way to securing your dream home and starting the next chapter of your life.