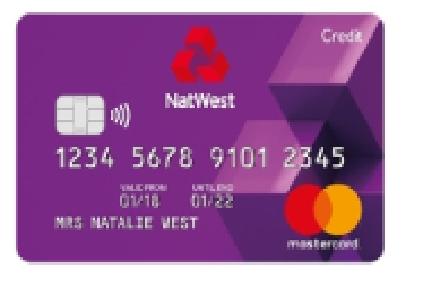

NatWest Balance Transfer

-

Annual Fee

Varies according on the particular card variation.

-

Intro offer

-

Typically, these cards offer a 0% introductory APR on balance transfers for a certain period.

-

-

Rewards rate

Most balance transfer credit cards don’t come with any bonuses.

-

Recommended Credit Score

Recommended Credit Score: Good to excellent credit score.

For 14 months, balance transfers have 0% interest.

Transferring balances must be done within three months of opening an account.

After the account is opened, you have a 14-month 0% offer; after that, regular rates are in effect.

Transferring balances is free of charge. No yearly charge

- Pros:

- Long interest-free period on balance transfers.

- No annual fee.

- Can manage the card via mobile app.

- Cons:

- Balance transfer fee.

- No rewards program.

Have you given any thought to transferring balances? Many people transfer balances on a regular basis, and in these kinds of circumstances, having the appropriate credit card may be quite helpful. The NatWest Balance Transfer Credit Card was developed for just this reason. This credit card not only allows debt transfers, but it also comes with a host of MasterCard advantages, no annual fee, and 14 months of interest-free credit.

As you can see, you shouldn’t take this card lightly because it’s not something you find very often. It is imperative that you take the time to understand more about it because of this. You may be confident that this article contains all the information you require if you think this credit card is a good fit for your needs. Let’s explore its characteristics in more detail as we continue to read.

What prerequisites must be met in order to apply for the NatWest Balance Transfer Credit Card?

The prerequisites for submitting an application for a credit card are extremely important; in fact, they are among the most important parts of the application procedure. You cannot proceed with your application if these prerequisites are not met. But there’s no need to worry too much about them because they usually consist of fundamental standards that most people use as a reminder. However, it’s imperative that you make sure to complete each one. Let’s investigate more closely:

- You have to be a resident of the United Kingdom.

- Candidates must be at least eighteen years old.

- Minimum Annual Income: It is necessary to have a minimum annual income of £10,000.

What paperwork is required in order to apply for a NatWest Balance Transfer Credit Card?

You will always need to provide some documentation when applying for a credit card. Generally speaking, credit card applications are meant to be simple processes that don’t demand a long list of documentation. Digging into obscure records from decades ago won’t be necessary. Let’s go over the key documents:

- Identity: In order to proceed with the application process, a legitimate form of identity is needed.

- Proof of Residence: You must present official paperwork attesting to your present address.

- Proof of Income: The application requires documentation attesting to your income.

For whom is the NatWest Balance Transfer Credit Card appropriate to apply?

Have you ever thought about which profiles this credit card might work best for? Before exploring these profiles, note that none of them need you to follow them religiously. You don’t have to meet any requirements in order to take use of this credit card’s features. It’s fantastic if you happen to fit one or more of these profiles, but it’s okay if you don’t. Let’s investigate these possible personas.

NatWest Customers

Those who are now customers of this business make up the first profile that I would think is perfect for applying for this credit card. It is customary for current members to receive extra perks when they apply for more services. Therefore, in order to take full advantage of the incentives offered, if you are currently a customer of this business, I strongly advise you to apply for this credit card.

People Taking Part in Balance Transfers

If you move balances on a regular basis, you probably know that there can be expensive and annoying fees involved. This credit card provides an answer: during the first fourteen months, debt transfers will be eligible for a 0% interest rate, and more significantly, there won’t be any expenses associated with the transfer, not even an annual fee.

For people who want to apply for the NatWest Balance Transfer Credit Card, here is some advice:

Are you trying to find the greatest online guidance on how to apply for the NatWest Balance Transfer Credit Card? Since I’ve effectively done the searching for you, I’m sure your adventure will be both incredible and quick. All you have to do to obtain thorough understanding and a helpful tip is to study these two articles on this credit card.

Think about how few articles—at least, I hope so—offer guidance on how to apply for a particular credit card. But that isn’t the primary idea. The important thing to remember is that applying for a credit card might be nerve-wracking, particularly if you haven’t done it before.

Therefore, my best recommendation is to get in touch with the organization if you’re having trouble with the application procedure. Making contact with the credit card issuer can make your life a lot easier. You just need to get in touch with them, and they will be happy to help you; believe me when I say that asking for assistance in these kinds of situations is quite acceptable.

Is applying for this credit card truly worth it? Let’s weigh the benefits and drawbacks.

This credit card, however, is an exception; with proper use, it can be a great credit card. But it might not be the best choice for you to apply for this card only on the basis of my advise. It’s important to consider whether a card will fit into your lifestyle before selecting it. The fact that this card fits my lifestyle is what makes me view it positively.

Regretfully, it might not be the case for you that what works for me, and that’s okay too. You don’t have to push yourself to submit an application. Should the advantages and disadvantages of this card align with your spending patterns, it could be a worthwhile choice. Cons include its specificity and emphasis on balance transfers, however for people who regularly shift balances, these features may be helpful. Its value ultimately comes down to how well it suits your requirements and tastes.

Apply for the NatWest Balance Transfer Credit Card right now.

Are you willing to apply for this credit card and make the big step? You seem prepared for this stage, and I have faith that the choice you choose at the end will be the greatest one for your particular situation. All you have to do is click the link provided below if you decide to proceed with the application procedure. This will take you right to the application page, where you can easily start the process.